Medicare: Choosing the Right Options at the Right Price

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). However, working through Medicare plans, parts and options to make the right choices may often feel like trying to solve a Rubik's cube.

As a certified specialists they keep up to date on all things Medicare so that they can guide you through your options, explain both the savings and advantages and get you enrolled, at no additional cost to you, the client.

As a certified specialists they keep up to date on all things Medicare so that they can guide you through your options, explain both the savings and advantages and get you enrolled, at no additional cost to you, the client.

Traditional Medicare and Supplemental Options

Part A: Hospital CoverageEveryone enrolled in Medicare receives hospital coverage and most people don't have to pay a premium for Part A. There is however a hefty deductible (in 2021 it was $1,484 for each benefit period) and so depending on your circumstances you may opt to purchase supplemental or Medigap coverage.

Part B: Medical CoverageThis part of Medicare covers outpatient services such as doctor visits, medical equipment, lab tests, diagnostic screenings, ambulance transportation and other services. If you don't have other coverage, it is important to sign up for this when you first enroll or you might have to pay a higher premium later. The annual deductible for Part B in 2021 is $203 no matter when your plan becomes effective.

Part C: Medicare AdvantageMedicare Advantage plans are offered by private health insurance carriers. These plans may offer additional services and benefits that is not available with Medicare Part A and Part B alone. They may help you save on out-of-pocket costs, and place an overall cap or maximum limit on these costs. You can choose to have Medicare Part A and Part B, or a Medicare Advantage plan. You cannot enroll in both types of plans.

Part D: Prescription Drug CoverageTo get prescription drug coverage, you need to enroll in either a stand alone Part D plan or a MAPD available in your area. To enroll in a Part D plan you must have part A and be eligible for Part B. Again, if you don't have other credible coverage, it is important to sign up for this when you first enroll or you might have to pay a higher premium or late enrollment penalty later.

Supplemental Coverage - MedigapThere are premiums for a Medigap policy and each plan is identical in benfit (all Plan G's are the same). Most plans have automatic crossover - meaning provider bills Medicare directly then the balance is sent to the supplemental plan for them to pay their share. This can make for a very streamlined experiance.

|

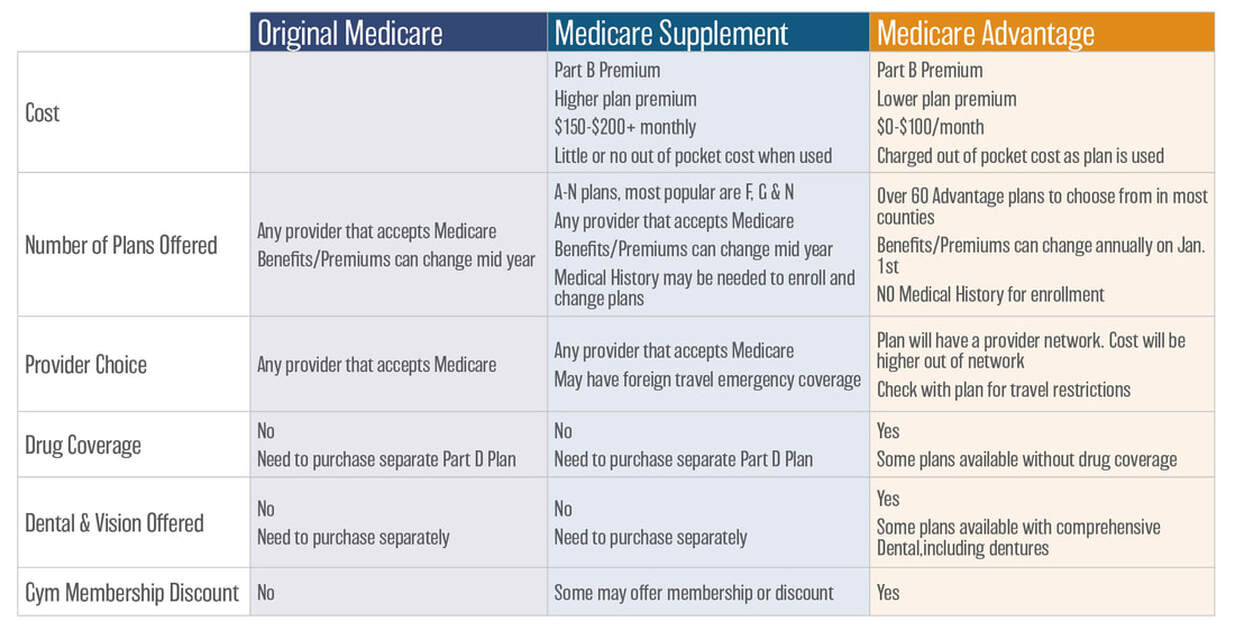

Medicare Advantage Vs. Medicare Supplement + Plan D

Advice from the Medicare Rights Center

|

The Medicare Rights Center, a nonpartisan, not-for-profit consumer service organization, has a list of common mistakes new Medicare enrollees make - here are the top two.

1. Not signing up for Medicare at the right time Timing, as they say, is everything. It’s especially important when it comes to enrolling in Medicare. As you approach 65, you’ll want to enroll during what the government calls your initial enrollment period (IEP). This seven-month period goes from three months before the month in which you turn 65 until three months after. If you don’t sign up during your IEP, you will get another chance to enroll during Medicare’s annual general enrollment period, from Jan. 1 through March 31 of each year. However, if you enroll at that time, your coverage won’t begin until July. And, because you enrolled late, your monthly premiums for Medicare Part B — which covers your doctor visits and other outpatient services — will likely cost you more. 2. Confusion about the special enrollment period If you are 65 or older, when you stop working and lose your health insurance coverage or when the insurance you have through your spouse ends, you’ll need to sign up for Medicare. Medicare has created a special enrollment period (SEP) that lets you do that without facing a late enrollment penalty. Again, timing is everything. What many people don’t realize is that you can only use this SEP either while you are covered by job-based insurance or for eight months after you no longer have job-based insurance. Note: Medicare does not count retiree health insurance or COBRA as job-based coverage. So, if that’s the insurance you have, you’ll need to reread mistake No. 1 and sign up when you turn 65 or face that late enrollment penalty. |

Some Common Mistakes

Not signing up when you are initially eligible, not taking advantage of open enrollment, not thinking ahead, picking a plan that doesn’t have your doctors, misunderstanding your job’s insurance, not understanding your out-of-pocket expenses, and not understanding your current benefits.

We are Here to Help YouWe take your insurance coverage seriously. Give us a call or schedule an appoint and we will fully assess your options, consider your care provider needs and make sure you make the right choice for the right price.

|